Don't miss...

When to Shop Around for Better Car Insurance Rates

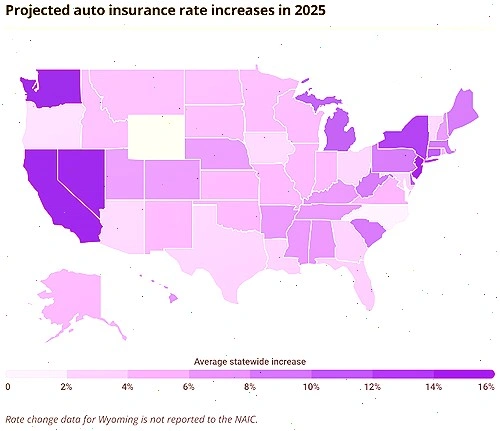

If it’s been more than a year since you compared car insurance quotes, you could be overpaying. Rates fluctuate frequently — not just because of your personal driving history, but due to changes in your zip code, vehicle, insurance market, or even your credit score. In this guide, we’ll explain the best times to shop

The Cheapest Full Coverage Auto Policies in 2025

Looking for full coverage auto insurance that won’t drain your bank account in 2025? You’re not alone. While full coverage provides peace of mind with protection beyond liability — including collision and comprehensive — it can also be costly. But don’t worry, you have options. We’ve analyzed quotes, discounts, and customer satisfaction data to uncover

Usage-Based Insurance Explained: Save If You Drive Less

What if your car insurance rate was based on how well and how often you actually drive — not just your age, ZIP code, or credit score? That’s exactly what usage-based insurance (UBI) promises. If you’re a safe driver, someone who works from home, or just don’t put many miles on your vehicle, usage-based car

How Credit Score Affects Car Insurance Rates (And What to Do)

You’ve heard that your credit score can affect your ability to get a loan or credit card — but did you know it can also impact your car insurance rate? In most states, your credit score plays a surprisingly big role in how much you pay for auto coverage. In this guide, we’ll explain why

Comparing Car Insurance by Zip Code: Does It Really Matter?

Ever wonder why your friend in a different neighborhood pays hundreds less for the same car insurance coverage? The answer might be in five little digits: your zip code. Yes, where you live can significantly impact how much you pay — even if everything else is the same. In this article, we’ll explain why car

Why Young Drivers Pay More — And How to Cut the Cost

If you’re under 25, chances are your car insurance feels outrageously expensive. And you’re not imagining it — young drivers consistently pay some of the highest premiums in the U.S. But why is that? And more importantly, what can you do to lower your costs without compromising on coverage? In this article, we’ll explore the