High-Risk Driver? Here’s How to Still Save on Insurance

Being labeled a high-risk driver can feel like a financial penalty that never ends — higher premiums, fewer discounts, and limited options. But the truth is, you don’t have to pay sky-high rates forever. Even high-risk drivers can take smart steps to lower their insurance costs. Whether you’ve had accidents, DUIs, lapses in coverage, or

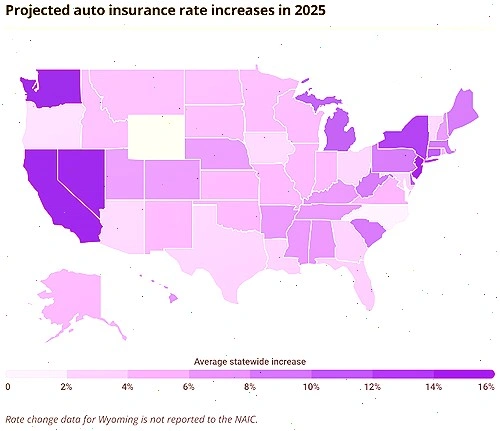

Best States for Cheap Auto Insurance in the USA

Car insurance premiums in the U.S. vary dramatically by state — sometimes by more than double. Factors like local laws, population density, weather patterns, and accident rates all influence what you pay. So, where can you find the cheapest auto insurance in America in 2025? We’ve analyzed the latest national data, insurance reports, and policy